This week, the US House of Representatives will take up reconciliation legislation, amended and approved in the US Senate last month, that would drill major, damaging holes in the Affordable Care Act. Though the bill has zero chances of becoming law because of a certain veto by President Obama, it is – by the Democrats’ count – the 61st time the House has voted to repeal all or significant parts of the health reform law.

Why, people often ask me, do Republicans hate the ACA so much?

This past week’s New York Times Upshot article, I believe, provides a major part of the answer. Briefly, “it’s the taxes on the wealthy, stupid.” Specifically, it’s about two new Medicare taxes that went into effect in 2013 only on higher income Americans:

- ACA Medicare Part A Payroll Tax: Beginning in 2013, individuals with earnings above $200,000 and married couples making more than $250,000 got an increase in the Medicare part A payroll tax of 2.35%, up from 1.45% (a .9% increase), on adjusted income over the threshold. (2016-25 take = $123 billion)

- ACA Unearned Income Tax: This same group also now pays a new 3.8% unearned income (capital gains) tax on interest, dividends, annuities, royalties, rents, and gains on the sale of investments over the threshold. (2016-25 take = $222.8 billion)

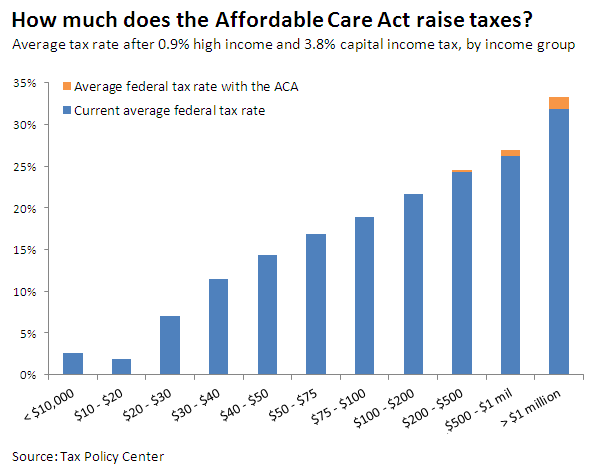

It’s a lot of money and it’s a lot of money taken exclusively from the top 5% of America’s wealthiest, ($345.8 billion between 2016-25) and especially from the most wealthy as the chart below demonstrates:

As the Times article makes clear, these new taxes are so damn big (when combined with higher taxes from the 2012 American Taxpayer Relief Act) that both increases literally reversed the majority of the last 20 years decline in the effective tax rate of America’s 400 wealthiest taxpayers!

Every leading candidate for the 2016 Republican presidential nomination has a tax reform proposal that promises major tax cuts for the wealthiest. If there’s anything close to doctrinal orthodoxy among today’s Republican political class, it is the inviolability of lowering taxes for the upper class. The ACA not only raised taxes on the wealthiest, it committed the most heinous offense imaginable to Republicans by increasing taxes on unearned income.

And it’s true, these folks get bupkis in benefits from the ACA.

But what about the individual mandate? Isn’t that reason enough to hate the ACA? No. It emerged in the late 1980s/early 1990s into the public’s consciousness because of Republican/conservative advocacy: Mitt Romney, Newt Gingrich, Bob Dole, the Heritage Foundation, on and on. They only abandoned it when Obama and Democrats embraced it.

What about states’ rights and the federal takeover of health care as the ACA does? Like Democrats, Republicans are opportunistic federalists, embracing that value when it suits their larger objectives and discarding it when inconvenient. For example, every Republican controlled state could pass a law tomorrow to permit their citizens to buy health insurance across state lines — a boilerplate Republican proposal. They don’t do it because it doesn’t make sense and it’s a phony solution. State likes Georgia that tried it got zero takers. So national Republicans routinely propose to override state sovereignty and require that all states mess up their health insurance marketplaces to allow this.

But taxes on the wealthiest — no wobbly or wiggle room there. Many ironies pervade this. In 2009-10, if Republicans had continued to cooperate on health reform with Democrats, abandonment of these wealth taxes would have been a bottom-line demand that Democrats would have accepted as the price to get a bipartisan deal. Indeed, the Senate wanted all ACA financing to come from within the health sector itself (including a much, much larger “Cadillac Tax” that was just postponed for two years); the House of Representatives demanded taxes on the wealthy, and that was a compromise between the two Chambers. A little over 20% of ACA financing comes from the new Medicare taxes on earned and unearned income — a lot and much less than the House preferred.

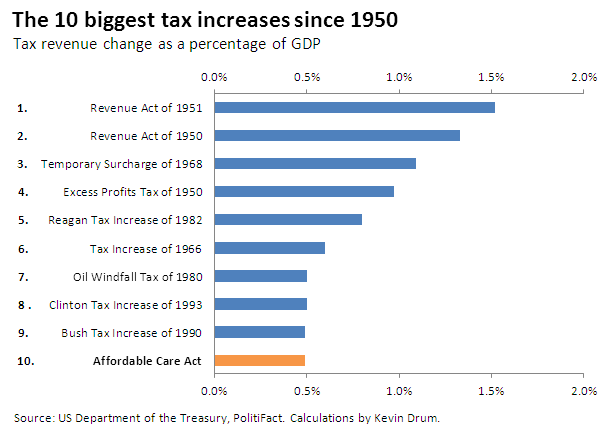

Finally, worth keeping in mind that the ACA’s new taxes, while substantial, don’t look all that big in the context of the other major tax packages approved since 1950, as the chart below shows:

So why don’t Republicans talk about repealing these taxes as part of their shticks? Fair question — I believe doing so would badly dilute their ACA repeal message about saving US health care. So repeal of the dreaded Medicare taxes can only happen in the context of full ACA repeal — and that is one of the main substantive reasons why Republicans must keep going back to this well.